The internal rate of return method (IRR method) is another method of investment evaluation with discounted cash flow. It is an alternate method to net present value but is closely related to it2.

The internal rate of return of a project is the discounted rate of return on the investment.

- It is the average annual investment return from the project.

- Discounted at the IRR, the NPV of the project cash flows must come to 0.

- The internal rate of return is therefore the discount rate that will give a net present value = Rs.0.

A company might establish the minimum rate of return that it wants to earn on an investment. If other factors such as non-financial considerations and risk and uncertainty are ignorant:

- If a project IRR is equal to or higher than the minimum acceptable rate of return, it should be undertaken.

- If the IRR is lower than the minimum required return, then we will reject it.

In investment decisions, the project is accepted or considered worthy if the required rate of return is less than the Internal Rate of Return or IRR. This is called the IRR Rule. This suggests that an investment is acceptable if the IRR exceeds the required return. It will reject otherwise. In other words, this investment is economically a break-even proposition when the NPV is zero because the value is neither created nor destroyed.

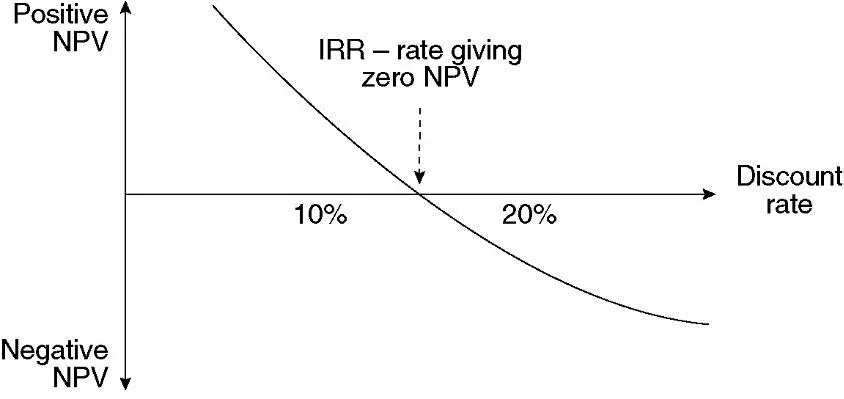

Since NPV and IRR are both methods of DCF analysis, the same investment decision should normally be reached using either method. The internal rate of return is illustrated in the diagram below:

Calculating the IRR of an investment project

An approximate IRR can be calculated using interpolation or by trial and error. To calculate the IRR, you should begin by calculating the NPV of the project at two different discount rates.

- One of the NPVs should be positive, and the other NPV should be negative. (This is not essential. Both NPVs might be positive or both might be negative, but the estimate of the IRR will then be less reliable.)

- Ideally, the NPVs should both be close to zero, for better accuracy in the estimate of the IRR.

When the NPV for one discount rate is positive NPV and the NPV for another discount rate is negative, the IRR must be somewhere between these two discount rates.

Although in reality, the graph of NPVs at various discount rates is a curved line, as shown in the diagram above, using the interpolation method, we assume that the graph is a straight line between the two NPVs that we have calculated. We can then use linear interpolation to estimate the IRR, to a reasonable level of accuracy.

Formula:

IRR = A% + (NPVa /NPVa – NPVb) x (B – A)%

Ideally, the NPV at A% should be positive and the NPV at B% should be negative.

Where:

NPVA = NPV at A%

NPVB = NPV at B%

Frequently Asked Questions

What is the Internal Rate of Return?

The internal rate of return (IRR) measures the return of a potential investment. The calculation excludes external factors such as inflation and the cost of capital,

What is the difference between IRR and ROI?

ROI and IRR are complementary metrics and the main difference between the two is the time value of money. ROI gives you the total return of an investment but doesn’t take into consideration the time value of money. IRR does take into consideration the time value of money and gives you the annual growth rate.

Why is it called the internal rate of return?

One such method of capital budgeting is the internal rate of return (IRR). The rate of return at which a project’s net present value is equal to zero. They refer to it as “internal” since it does not take into account any external factors, such as inflation.

What does 10% IRR mean?

An investment might have a 10% IRR, for instance. This means that throughout an investment’s life, a 10% annual rate of return can be expected. IRR is a specific discount rate that results in a net present value (NPV) of zero when applied to expected cash flows from an investment.